Portfolio Strategy

How to value Facebook?

There is a lot of hoopla around the Facebook IPO and how to value the shares of the social networking giant. At an expected $100 Billion valuation, Facebook will be selling at around a PE of 100 and a Price to Sales multiple of 27 based on full year 2011 numbers of $3.7 Billion in revenues and $1 Billion in net income. Those are lofty multiples no matter what kind of investor are you.

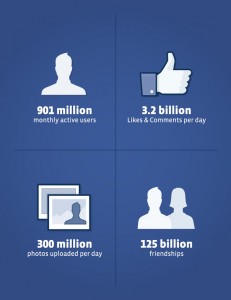

However, when it comes to looking at Facebook you have to take certain considerations unique to the company in place. Facebook is not only the biggest social network it is pretty much a monopoly when it comes to social networking. It is also a platform for anything related to social networking. This is not to be taken lightly. The fact that it has 900 million users is a testament to the wide adoption of its platform. If you are an individual, brand, a company or if you represent a cause who wants to interact with a wide array of your friends or with the public then you HAVE to be on Facebook.

Right now the company has two primary sources of revenues: advertising and revenue sharing for facilitating payments for digital goods for the various Applications hosted on its platform. On Wall Street, company valuations are a straightforward exercise where you plug in certain revenue and expense growth rates to come up with a multi-year cash flow statement that will help you come up with a final terminal and present value for any company. This is a linear exercise and final valuations are highly sensitive to the discount rates and the growth rates you plug in based on your best guess-estimates.

However, when it comes to Facebook, a linear valuation model is not appropriate because Facebook’s earnings have a lot of optionality in them because of the company’s monopoly status. When estimating future earnings, you have to look at them with an options pricing model and not a simple linear discounted cash flow model. While the company relies on simple banner advertising right now for the bulk of its revenues, a prudent analyst cannot ignore the fact that Facebook can alter its revenue strategy and be much more successful given its wide adoption status and its monopoly power that translates into very high switching costs for its users.

As a simple illustration of the wide array of options that can be available to Facebook is the ability, if it so chose, to charge subscriptions to its users particularly its business users who use brand pages. A case in point is the recent announcement by General Motors that it will stop advertising on Facebook. Lost in that Wall Street Journal story is the fact that while GM spends $10 million dollars on advertising on Facebook, it actually spends 3 times that, $30 million, to advertising and public relations agencies just to maintain its presence on the various brand pages for its cars on Facebook. Think about it. Would a company spend $30 million dollars on a platform that it thinks is ineffective? Now consider this: How much do you think GM is willing to pay Facebook in subscription fees in order to maintain its various product pages on the social network? $1000 a month? A million dollars a month? 1$ per “Like” per month? Per year?

Perhaps, GM is not a good example because of its size. Think of any company’s presence on the internet. Right now the “proper” presence is to have all 3: a website, a Facebook page, and a Twitter account. A website will cost you around $15 annually to register your domain name and about $100 per year to rent space on a server to host your website online or a total of $115 to $150 for the most basic essentials for having a website. A Facebook page is free right now but how much would you pay for one if you are a business, a politician or a public figure? How much are you willing to pay if you already have a page with thousands of fans or customers? Yes you are stuck and Facebook has you by your you know what. Starting with a subscription model when you have 900 million users will lead to a certain adoption rate that is different than having such a revenue model when you start out the company and have a small number of users.

This is a simple exercise of the power of having a near universally adopted platform and having a monopoly in an entire category. For this reason, and the hoopla surrounding the IPO, I predicted yesterday that we will likely see a big pop in its first day of trading. A 100 PE off of 2011 earnings may be egregious but that can very likely be a 20 multiple off of 2013 or 2104 earnings. It’s caveat emptor if you are considering buying shares of Facebook but keep in mind that there is more to the valuation story than just a simple discounted cash flow model.

Tagged NASDAQ:FB

If you liked this article please follow us on Twitter and Facebook